Much thanks to @DV_situations on X, where I got this idea from:

This company is kind of a dream, it ticks so many boxes, and the first one is that the market is SO pessimistic on it for reasons I can see but don’t agree with.

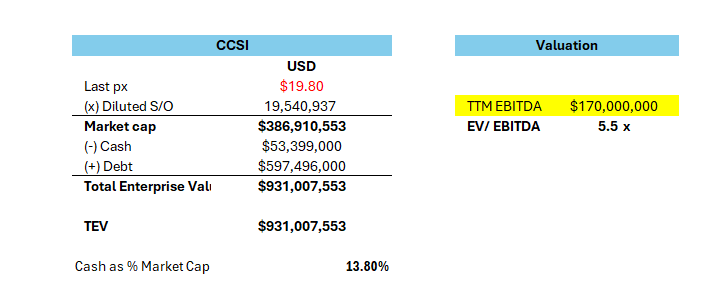

We have a company here with a sticky SaaS product trading at EV/EBITDA ~5.5

Growing Revenue!

80% Gross profit margin and a close to ~45% EBIT margin.

Spin-off, so forced sellers pushed price down.

If there is literally one skill an investor needs to outperform, its the ability to buy when others are pessimistic. When things seem bad.

CCSI has been battered. Bad optics. It dropped 10% on a debt downgrade (that I can argue was fundamentally better for the company).

Right now, I’m buying from pessimists. I am LONG.

An opportunity for my subscribers

Of my last five Substack pitches, two have already doubled. The others? Still playing out.

Now I’ve got another opportunity for you, the chance to lock in my research at 50% off.

I’m not going paid yet. This is just for those who want to pledge early and secure access before the gate closes.

For the first 10 annual pledges, it’s just $199/year. That’s $16/month—basically the price of a burger.

After that, the price goes up. No exceptions.

These first 10 pledges will lock in the lowest price this research will ever be offered at.

Look—if you’d put $10,000 into Super Group, one of my recent calls, you’d be up $15,000. That’s a 1.33% research cost at the $199 tier.

Pledge now. Don’t blink—someone else will take your slot.

What does CCSI do?

A patient walks into a clinic with a weird wart in a weird place. The doctor needs to know if the insurer will pay, so he tells the nurse to send a prior-authorization.

The nurse fills in the details and hits Send. It looks like a fax, but there’s no fax machine. It’s 2025. Either the clinic or the insurer (often both) uses CCSI’s eFax: they keep a normal fax number, and the “fax” is delivered digitally, encrypted, logged, with a delivery receipt into a web inbox or straight into their system.

The industry is trying to move off fax. A newer standard, FHIR, lets clinics, hospitals, and insurers send the data itself (as tidy JSON) so software can auto-populate the patient’s record instead of a human re-typing a PDF.

Here’s where CCSI bridges both worlds (with its new products Unite, and Clarity):

Unite: when the counterparty already supports APIs, that same Send action skips the PDF/fax entirely. Unite packages the prior-auth as FHIR and delivers it straight to the insurer’s endpoint (no phone lines).

Clarity: when something arrives as a fax or PDF, say a small practice’s handwritten note, Clarity reads it (OCR/NLP), pulls out the patient info and codes, and drops clean, structured data back into the hospital’s system.

Most hospitals already run Epic Systems as their electronic health record. Epic is where doctors chart and store data, the inside of the hospital. CCSI operates between organizations: it moves information to payers, pharmacies, agencies, and small clinics that are all at different tech levels.

Epic does offer native FHIR/Direct rails, but CCSI gives one workflow with two rails (API when available, secure cloud fax when not), plus the cross-organization transmission audit trail, credential/key management, retries, and automatic failover, all without a new IT project every time a partner upgrades or breaks an endpoint.

Fax is shrinking, but it isn’t gone. The long tail still posts fax numbers, and the U.S. hasn’t banned fax. CCSI keeps those connections working now, while quietly flipping them to APIs with Unite and cleaning the leftovers with Clarity. That’s why Epic doesn’t “replace” CCSI: Epic keeps the chart straight; CCSI gets the chart across the moat, on whatever rail the other side can handle today, while the industry transitions.

Where I think the market is wrong

If you run a reverse DCF, the market is pricing CCSI as if…

…margins collapse from ~45–54% EBITDA to ~35%

(yet in reality the mix is shifting to higher-margin API/AI products—Unite/Clarity drop the telecom tolls).…revenue declines structurally

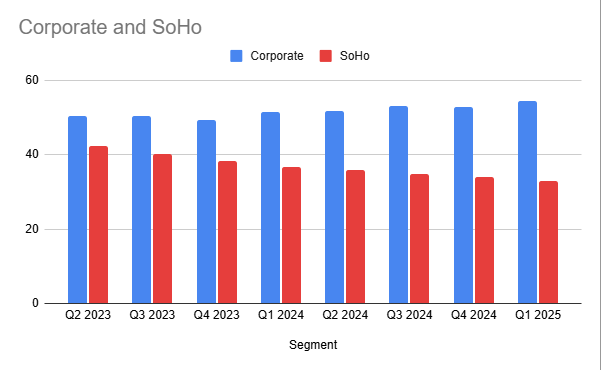

(in reality the Corporate (enterprise/healthcare) segment is growing ~5–6% YoY, the revenue headline dip was a deliberate pull-back in low-value SoHo (Small office/Home office) advertising).…it’s barely a going concern

(they still print roughly $120m a year in FCF and are steadily deleveraging toward <2.5× net-debt/EBITDA).

Their revenue is far stickier than the market believes: hospitals keep their long-standing fax numbers for compliance and routing, and CCSI’s dual-rail setup (fax today, FHIR/Direct when ready) means customers can modernize without switching vendors. The base doesn’t need to churn for the mix to improve.

Topline Revenue decline

Two segments:

Corporate

~60k clients, up from 55k a year ago.

Net-dollar retention ~101% (vs 97.9% a year ago).

ARPA = $306.54/month.

Q1-25 revenue $54.3m, +5.6% YoY (record).

Margins: company adj. EBITDA ~54%; Corporate is the driver.

Story: sticky enterprise bridge (cloud fax + Unite APIs + Clarity doc-AI), baked-in audits/compliance, dual-rail (API when possible, secure fax when not).

SoHo

Strategic pullback: Management cut digital ads; letting the low-ARPU tail run off.

ARPA = $14.83/month.

Monthly churn 3.26% (lowest in 14 quarters; improving).

Q1-25 revenue $32.8m, –10.6% YoY; accounts 730k (vs 808k LY).

Lower margin vs Corporate; shrinking by design while cash is redeployed to delever and enterprise growth.

Corporate is the sticky bridge business. Cloud fax + API + document AI for institutions that must connect to thousands of messy outsiders. It’s growing mid-single digits with 100%+ retention and has 54% EBITDA margins.

SoHo is the deliberately pruned retail tail: low ARPU, higher churn, and shrinking by design after ad cuts. As more partners move to APIs, CCSI keeps the customer and earns more per transaction—because Unite/Clarity carry fatter margins than fax minutes.

Valuation

Path to value realization

Debt paydown will increase net income via interest saved. Every $100m retired saves =$6–6.5m annual. That is a LOT.

Buybacks. Buybacks after debt paydown will re-rate company to 10 EV/EBITDA or higher.

Corporate keeps growing.

The big risks

Epic/FHIR : Hospitals route via Epic/native hubs and cancel CCSI.

API ramp stalls: Unite/Clarity adoption too slow, “fax dinosaur” multiple persists.

Policy shock (fax bans): Sudden drop in faxable workflows.

Monitor

The big two- how we tell if this thing is working or not:

We watch corporate seat retention, if it drops below 98% we may have a problem, and I may have misunderstood how sticky their product is.

Interop (Unite/Clarity) revenue: if their new products grow, they will cement stickiness and longevity.

These are the fundamental risks I see for the company. If either plays out it means that clients are probably moving off CCSI and onto Epic Systems.

Sharp breakdown. Most posts only compare surface-level metrics ... this went deeper into NDR, ARPA, EBITDA margins, and even market motion. Really helps anyone evaluating healthcare SaaS. Appreciate the research-driven lens.

Why does this company even need to pay down debt? Their interest is covered 4x by EBIT. Retiring debt at 6.5% is hardly value accretive when you could be buying the stock at a 20% earnings yield. Thoughts?