Note, this would be a small position for me. I haven’t bought yet and may not. I like things a bit cheaper, but I am very inclined to take a position.

Super Group is a mature iGaming company (online casino, sports betting). Most of their revenue is generated from The Middle East, Africa, and North America.

They own a ton of Brands, the biggest being Betway, and Spin Casino (which is how they divide the segments). Betway used to only provide sports betting, but its Casino (within the Betway App) has grown significantly and is much higher margin than the sports betting.

These brands are managed by Neal Menashe who’s been with Super Group for 23 years (4 years as CEO).

The business generates cash. Industry EBITDA margins are around 20%. And the industry as a whole is investing heavily into acquiring market share of the growing sports-betting and online gambling market.

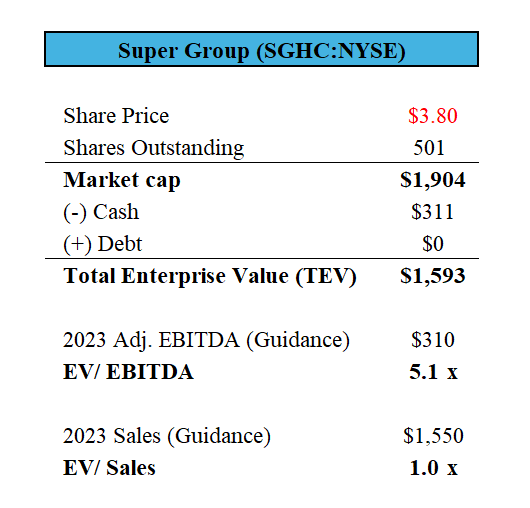

It simply doesn’t make sense for Super Group Limited to trade so far below peers, although I can give you a few reasons as to why I think it does.

The company has no debt, has grown revenue from €476M to €1,436M from 2019 to 2023, and has high quality assets. After trading within a range for the past 2 years, I think there’s a high probability for a break-out.

In the above image, “Rush Street”, “PointsBet”, and “Evoke” have all posted a decline in revenue, and all have significant debt.

Super Group posted a 21% YoY increase in its monthly active customers (EX-United States) in its latest filing. I believe this asset should trade at least at 2X Revenue or 10X EBITDA, a 100% increase.

Thesis:

Super Group is undervalued vs peers, partly because they withdrew from the US market, and because they grow more slowly. But, the company holds high quality assets, and dominates its current markets.

I believe the company is undervalued vs peers and on a standalone basis because it grows steadily and has a good, addictive, product.

Information Supporting Thesis:

Super Group came to market via a reverse merger with a SPAC in January 2022. I believe this is partly the reason for the discount vs peers because “SPAC” left a bad taste in people’s mouths.

The company recently acquired its “Technology Stack” from Apricot. This acquisition should lift margins and allow the company to operate more efficiently. Apricot is a third-party software developer who developed the sportsbook software. The acquisition, however, does contain earn-outs for Apricot:

Fortunately for shareholders the cash outflow per year is minimal, and this is a long-term strategic move which should save the company a lot in future. If the company does double its revenue in 10 years, that’s a good problem to have, not one we need to factor into the analysis now.

Super Group struggled in the US market against DraftKings and Flutter Entertainment, which lead to slower growth vs the two dominant companies in that market and led to Super Group’s withdrawal (not complete withdrawal) from the US Market.

The company is run by a shrewd capital allocator, who is constantly weighing up use of funds for marketing, acquisitions, buybacks, and dividends.

Price. Management. Company.

Price:

Honestly, price means nothing without some conviction on growth or the lack thereof.

YoY Revenue Growth:

2020: 90.7% (COVID Growth)

2021: 45.4% (Tapering of COVID Growth)

2022: -2.2% (Decline mainly attributable to Spin revenue decline, Canada introduced new regulation + Closure Netherlands. Betway revenue was essentially flat and returned to growth in 2023)

2023: 11.2%

Q1 2024: 5.4% QoQ

Q2 2024: 8.94% QoQ (Returning to growth)

A high quality company like this, in a growing industry, growing at 10%+ YoY should be worth more than a 5.1 EV/EBITDA multiple.

The management also spends quite a bit more on marketing (27% of revenue sometimes) vs peers.

Management:

I like management. Here are some quotes from the earnings transcripts.

Overall, our process our global footprint is strategic and selected, and we continually re-evaluate the market that we should enter as a market that we’re really operated. We will never stay in a market only for the sake of a larger footprint.

Our largest expense line item is market. Currently, we are spending 27% of net revenue to support the long-term growth of the business.

This is a conscious decision to spend more than the sector average and I’m watching it very carefully to ensure we are seeing returns. On economies of scale, I want to point out this is a market-by-market objective.

Of course, when it comes to transformational M&A, you can't do a deal if the other parties well overvalued. That's number one.

Good Company/Competitive Advantage

I believe the products are quite sticky. Gamblers will learn how their preferred APP works, and this makes it quite sticky.

It’s similar to a brokerage account- you know where to go to buy a stock, to place your limit, etc.

I think the company has an advantage in Africa because it has been operating there for so long. It has definitely struggled in the US vs Draft Kings and Flutter Entertainment.

Target & Weight:

I would only do 5% for now. It’s cheap on a standalone basis, and is moving to make EBITDA margins of 20% more consistent. Buying their software from Apricot still needs time to digest, and I think this will add to their efficiency.

Monitor:

Regulation is regulation and I can’t predict that. I want to see what happens to their small operation in the US, it could turn out promising.

Evoke had had some serious regulatory/AML problems with large/VIP middle eastern clients, which ended in a settlement/fine payment and "voluntarily" discharge of a verity profitable business. One may assume, that there are potentially significant such risks present in case of the Super Group as well.

btw : Are you still negative on Gravity.

I ask as some authors that have a good track record (like Le Shrub) event recently pointed it out and mentioned a successful roll out in China...