I must admit, I’ve gotten a bit lucky with these last picks. They have all run up considerably in a short space of time. However, it is far from over.

CorMedix (CRMD) +20%

CRMD is up around 20% since my post, but I still expect a volatile ride.

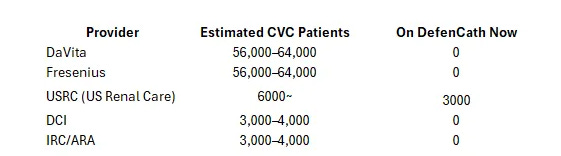

On this news where management stated a LDO (large dialysis organization) customer began ordering and will target 50% more patients than previously communicated. Great news. If the customer is Fresenius (which it probably is) then the revenue ramp will be big. There are still many moving parts to this thesis. Take a look at CorMedix Part 2 to understand it better. You must be comfortable with these risks if you want to be able to hold this stock.

Something worrying me about CRMD now is just the fact that its rated as “Bullish” by blogger sentiment on Tipranks. Just means expectations are getting high, and creates a vacuum gap for any negative news to the downside. Biotech is volatile.

LifeMD (LFMD) +122%

LFMD has earned an incredible 122% since my post. In a very short space of time. I have taken off 75%, so booked a healthy profit and just letting the rest ride where it may.

Revenue has been beating estimates. Active subscribers (main metric to watch) growing fast. Eventually they might sell WorkSimpli and then this becomes a real takeover candidate. I still think HIMS should take them out to compete with Amazon, LFMD has built a great telehealth platform.

They’ve expanded Medicare acceptance, and they’ve got NovoCare and LillyDirect partnerships. Quite bullish now that HIMS and Novo are at war.

When LFMD achieve scale, with its 80%+ gross margin, it will be extremely profitable.

I’m also just a bit nervous that sentiment is so bullish on them now. Always nice to invest when the stock is out of favor instead, hence why I took some off.

Taste Gourmet (HK:8371) +20%

I am very happy with Taste Gourmet results. Revenue growing fast, net profit compressed as I expected given that they are opening so many new stores. (New stores take on average 6 months to breakeven and then 2 years to reach max profitability).

If store openings decline, net profit will expand and the dividend will increase.

If store openings increase, revenue will expand, and net profit will catch up eventually.

Happy holding on a 10% dividend yield. And expect dividend to increase end of year.

Betsson (BETS‑B) +35%

Betsson is an incredible compounder with an incredible operator. In an very undercover “theming” sector. iGaming is growing fast, and Betsson is poised to capture this growth through their own games and their technology platform- which I think is an undiscounted advantage they hold.

Latest earnings tick all my boxes. My job is to just leave this stock alone and let it do its thing.

They have a very good acquisition strategy, and I believe their technology platform is part of it.

They are growing fast in South America. They have a new office in Buenos Aires, Argentina, and have got their license and launched operations in Brazil. I am excited to see what they manage. Brazil is growing fast. Latam America accounts for 25% of Betsson’s revenue.

Happy to hold this as it steadily rises.

Thank you for the CorMedix write-up. What do you make of their recent capital raise?

Interested in Taste Gourmet Group