Everything kind of depends on the price of DefenCath after the TDAPA cliff-effect.

I would like for you, the reader, to understand that this is likely to be an extremely volatile stock. Press releases on the rollout to LDOs, news from the CMS, or even the RWE data could create extremely wild swings in the stock price.

What Could Break the Thesis?

Everything comes down to DefenCath’s price after the TDAPA cliff. What would break the thesis:

MA (Medicare Advantage) plans might refuse to pay extra.

CMS could say, “We’re bundling it at the standard rate—take it or leave it.”

LDOs (Large Dialysis Organizations) might simply say, “We can’t afford it.”

If DefenCath can hold its price at even $50 per vial, the company could do very well.

Understanding CMS, Medicare Advantage, and DefenCath

The Centers for Medicare & Medicaid Services (CMS) is the government agency that sets the rules and pays for dialysis care. Traditional Medicare (government) pays clinics a bundled rate (referred to as the ERSD bundle) for each dialysis treatment—about $265 per session—which covers all the basics: staff, supplies, and routine medications.

Medicare Advantage (MA) plans are private insurers that get a monthly payment from CMS to cover all a patient’s care—including dialysis, hospitalizations, and medications. These plans have more flexibility than CMS to negotiate directly with companies like CorMedix to adopt new treatments.

Right now, CMS supports DefenCath through the TDAPA program, paying clinics the full price of the drug (about $250 per vial) for the first two years, making it financially easy to adopt. But after that, payments start to drop. Even if DefenCath proves it saves money by preventing costly infections, TDAPA’s structure is unlikely to change—the price drop-off (the “cliff effect”) will likely stay in place.

What CorMedix is really hoping for (and would turn it into a 20 bagger) is something called a carve-out—where CMS decides that DefenCath is so valuable that they pay for it outside the $265 dialysis bundle. But historically, CMS very very rarely grants carve-outs, and given the size of the dialysis bundle, adding a $250 drug per session would blow the budget apart.

Examples of Drugs that Failed to Get a Permanent Carve-Out (BUT):

Cinacalcet (Sensipar) — after its initial separate payment (TDAPA-like) ended, it was folded into the ESRD bundle in 2020. This caused losses for dialysis clinics, who then limited its use due to the high price.

Cinacalcet reduced hospitalizations (by managing secondary hyperparathyroidism) but CMS folded it in anyway.

Outcome: Use of the drug dropped and patients’ access suffered.

Phosphate Binders — previously paid separately, now bundled (effective Jan 1, 2025).

Despite concerns that including them in the bundle might harm patient access, CMS moved forward with bundling to simplify payment.

Read about more of the CMS problems here. Bundling caused large volume drops in many innovative new therapies.

But: These drugs above didn’t have the extreme life & cost saving potential DefenCath has.

Proving DefenCath’s Worth

I am quite unconcerned about CorMedix being able to prove DefeCath’s worth in RWE studies, for a few reasons.

The cost of a CRBSI (catheter related blood stream infection) is extremely high. (~$90,000-$120,000). So DefenCath will be able to reduce costs.

The European ‘copy’, Taurolock, is extremely similar and has been proven in a few European RWE studies.

I feel like the clinical study’s results were more of a verification of other research that is already out there.

DefenCath CAN save many lives AND a lot of money.

Stakeholders (CorMedix, CMS, MA plans, and patients) MUST come to an agreement otherwise they are killing people and leaving money on the table.

The TDAPA Bridge

TDAPA was created by CMS to encourage innovation. It allows new renal drugs and biologics to be paid outside of the bundle at their full wholesale price for a limited time—usually two years. And then there’s the 65% post TDAPA adjustment that runs for another 3 years. The post-adjustment was introduced in 2024.

TDAPA isn’t perfect, it actually discourages innovation in some ways. Plenty of folks in the industry have pointed out its flaws. Some companies have even pulled their products because the structure just didn’t work (e.g., GSK with Jesduvroq) . So while TDAPA helps DefenCath right now, I fully expect changes to be made in the future to make the program work better for innovative therapies. Only a crystal ball can answer how or when those changes will come.

For DefenCath the post-TDAPA adjustment was a critical lifeline. Its current Wholesale Acquisition Cost (WAC) is approximately $250 per vial. Under TDAPA, Medicare reimburses that full amount per vial, letting dialysis providers integrate DefenCath without jeopardizing their margins.

*DefenCath is also covered by NTAP (New Technology Add-On Payment) which is a Medicare reimbursement system that gives hospitals extra payments for adopting new, innovative treatments. For DefenCath, this means hospitals receive additional money on top of the regular DRG payment when they use the product during an inpatient stay. It helps hospitals afford new therapies while Medicare collects data for possible future inclusion in bundled rates.

June 2026 is where the risk gets turned on high. Even with the post-TDAPA adjustment, would the LDOs absorb the difference in price? I don’t believe they will, but the MA plans might.

Management’s Strategy

CorMedix’s team knows the cliff is coming. That’s why they’re working on:

Proving DefenCath’s value through RWE—tracking infection rates, hospitalizations, and cost savings.

Negotiating value-based deals with MA plans and LDOs to share risk and keep the price sustainable.

Medicare Advantage: Where the Real Opportunity Lies

About half of all ESRD patients are now in MA plans. Each infection costs these plans $90,000–$120,000, so they’re motivated to pay for prevention. CorMedix is betting that DefenCath can show enough real-world cost savings that MA plans will carve out payments or negotiate a value-based contract—keeping DefenCath priced sustainably even after TDAPA ends.

It won’t be easy—MA plans have budget constraints and need solid data. But that’s where the opportunity lies. If DefenCath’s data is strong, MA plans might just become its biggest supporters.

Other Opportunities for DefenCath

I haven’t yet touched on the other opportunities CorMedix is going for:

TPN (Total Parenteral Nutrition)

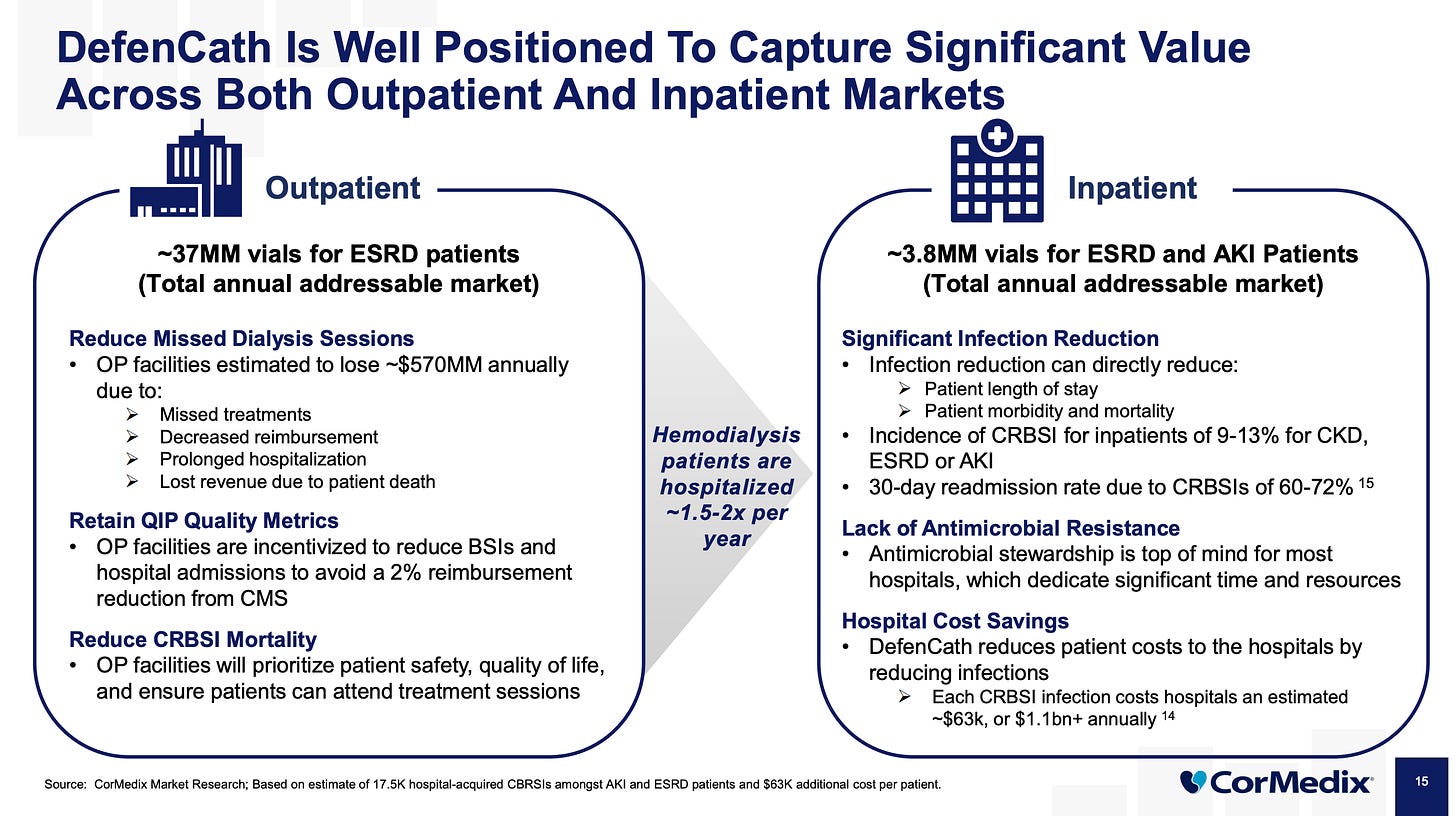

Inpatient (hospitals)

Total Parenteral Nutrition is a method of feeding patients intravenously when they can’t eat or absorb nutrients, often due to serious gastrointestinal diseases, short bowel syndrome, or certain cancers. Delivered via central venous catheters (CVCs) or PICCs, TPN carries a high risk of Central Line-Associated Bloodstream Infections (CLABSIs), with infection rates up to 26% and mortality rates of 12–25% per case. CorMedix is currently running a Phase III trial testing DefenCath in TPN patients to reduce these infections, targeting a U.S. market of approximately 4.7 million TPN infusions annually—a potential market worth $500 million to $750 million depending on price and penetration. Management forecasts peak annual sales of $150–200 million for DefenCath in this segment if it achieves solid uptake. The trial began enrolling patients in early 2025 and is expected to complete by late 2026 or early 2027.

Inpatient

DefenCath also targets hospital inpatients with ESRD and AKI—patients who often need a CVC for dialysis. Right now, hospitals get a break thanks to the New Technology Add-On Payment (NTAP)—Medicare covers 75% of DefenCath’s cost on top of the standard DRG payment. But that’s temporary and once NTAP expires in November 2026, hospitals will have to cover DefenCath from the same bundled DRG payment that also funds the patient’s entire stay. It’s a much smaller market compared to the LDOs.

Scenarios?

I could lay out a bunch of scenarios—bear, base, bull—but I feel like that wouldn’t really do justice to this situation. This is a drug that’s needed. It saves money. It saves lives.

The real crux of the thesis comes down to what kind of deals CorMedix can work out with CMS and Medicare Advantage plans. We’re in pretty uncharted territory here. But I believe DefenCath’s benefits are strong enough that they’ll create a big “pull” from stakeholders who want to see it adopted—even if that means tweaking policy to make it work.

We need to closely monitor those discussions, and the rollout. That will tell us what we need to know.

Really great analysis, thank you!

Thoughts on the recent capital raise?